Overview

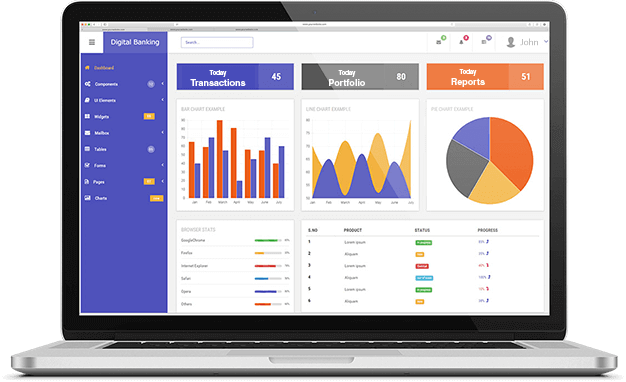

The client is an industry leader delivering banking solutions which includes Transaction Management, Account Management, Reconciliation Process, Bill Payments etc.

Business Need

Client would like to have a banking platform to manage Accounts, Financial Transactions, Payments with large volume of Data processing in real time.

Client Situation

Client wanted to have a portal with below key features and also looking for AMS (Application Maintenance and Support) of same.

- Manage accounts securely

- Manage transactions

- Manage Reconciliation process

- Processing large volume of data in real time

- Data security, Backup and Recovery practices as per Banking compliance standards

Technologies

Spring Boot, Glue (Authentication), Kong API (Authorization), Hadoop, AWS API, OAuth 2.0, Mifos, Kafka – q, MongoDB, Elastic Search

Recommended Solution

Banking Domain experts at WeblineIndia transformed every requirement of the client into a robust solution.

Few highlights –

- ACL based user management with different roles and permissions

- Secured Accounts and Transactions management

- Handling of huge Data traffic at any point of time without failure

- Scheduled reports for different activities such as, Various Intraday Core Banking Reports, Reconciliation Report, Weekly/Monthly Statements etc.

Result

Both, The Business and Household users can use a single platform easily for every Banking need.

- Cent percent reliability with zero unplanned outages

- Notifications as per user’s choice without any unscrupulous calls/messages

- Secured and handy payments mechanism under one platform for every biller set by users.

Testimonials: Hear It Straight From Our Customers

Our development processes delivers dynamic solutions to tackle business challenges, optimize costs, and drive digital transformation. Expert-backed solutions enhance client retention and online presence, with proven success stories highlighting real-world problem-solving through innovative applications. Our esteemed clients just experienced it.